GET 30 DAYS FREE ACCESS

TO BITCOIN TREND TRACKER

Hedgeye Pro Includes Our Full Lineup of Macro Investing Products

Risk manage your crypto positions with math and data, not NARRATIVES.

BITCOIN TREND TRACKER

An Indispensable Risk Management Tool for Crypto Traders…

Everything you need to effectively trade crypto:

✓

Make better sales at the top end of the risk range and purchases at the low end

✓

Backed by Hedgeye Founder Keith McCullough’s quantitative risk management process

✓

Get daily BUY | SELL trading signals for the world’s most traded crypto assets*

✓

Receive price, volume, volatility, sentiment and market data monitored by our Macro team

** As of 2022, the Trend Tracker delivers daily signals for Bitcoin, Ethereum, and a range of crypto ETFs (i.e. MSTR, BLOK, COIN, etc.).

Again, our Bitcoin Trend Tracker uses Bitcoin’s underlying price, volume and volatility trends to estimate the probable range for the cryptocurrency.

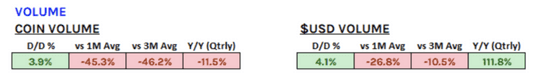

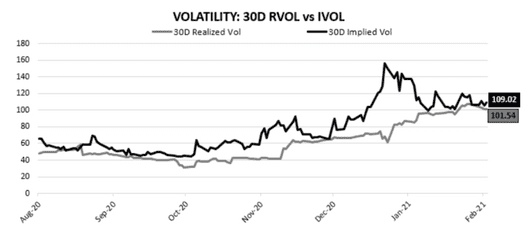

Here’s a quick look under the hood on February 19th using Bitcoin’s underlying price, volume and volatility data.

As Bitcoin hit new highs, coin trading volume was plummeting, -45% versus the 1-month average. Fewer transactions at Bitcoin’s all-time highs? Not good.

Meanwhile, Bitcoin volatility was creeping higher. Historical (or realized) volatility was steadily rising throughout the year. At the same time, expectations of future volatility (i.e. “implied volatility”) were falling.

This is a classic contrarian indicator.

In simple terms, as Bitcoin hit all-time highs (rising 100% in 2021) institutional investors were removing downside hedges on Bitcoin to capture the parabolic move higher… at precisely the wrong time.

Hedgeye Pro Includes Our Full Lineup of Macro Investing Products

The Crash: From Down -26% to Up +40%

The Bitcoin peak culminated over the weekend of February 20-21 when Bitcoin closed north of 56,000 only to plummet the following week.

Bitcoin Trend Tracker: A Buy Low, Sell High Tool

HODLing isn’t an effective risk management process. Timing the market cycles with quantitative algorithms (aka DATA) and getting out at the critical inflection points, is.

Hedgeye Macro analysts are neither Perma-Crypto Bears nor Bulls. We're opportunistic. We get you long to ride the rips, and then get you OUT to risk manage the dips (and protect your hard-earned capital).

Risk manage your crypto positions with math and data, not NARRATIVES.

That’s exactly why we developed our Bitcoin Trend Tracker - a daily dashboard designed with Hedgeye Risk Management’s proprietary trading tools applied to the largest cryptocurrencies, including Bitcoin, Ethereum, and a range of crypto ETFs (i.e. MSTR, BLOK, COIN, etc.)

It is designed to help ALL INVESTORS risk manage their crypto positions with MATH/DATA, not NARRATIVES.

ETF PRO PLUS

Our favorite ETF ideas—bullish or bearish

This monthly strategy note distills our macro research down to 15 to 20 exchange traded funds across the seven major asset classes. Updated weekly with Keith McCullough’s quantitative risk management levels, ETF Pro Plus keeps investors ahead of the next big market move.

BOTTOM LINE

“HODLing” hurts your portfolio. Applying a quantitative risk management process to crypto helps you protect your capital (and grow it).

WHAT’S INSIDE HEDGEYE PRO:

✓

Daily Risk Management Insight

The Macro Show video broadcast and The Early Look newsletter provide everything you need to know before the market opens.

✓

Weekly ETF Signals & Macro Roundup

ETF Pro Plus is designed to help you buy low and sell high using quantitative risk management levels. Market Edges identifies macro risks and opportunities.

✓

Monthly ETF Strategy Note

Keep ahead of the next big market move. Get 15 to 20 specific ETF exposures (bullish and bearish) across the seven major asset classes.

✓

Quarterly Investment Outlook

A foundational analysis of the top 3 market-moving macroeconomic trends.

In anticipation of his November 2020 #Quad4 call, McCullough bought back all of his Bitcoin on October 12, 2020 (after selling down his position during September 2020):

“I started selling my Bitcoin in the first week of September [2020], I sold it all the way to the first week of October, and then I bought it all back (on October 12th 2020).” – Hedgeye Founder & CEO Keith McCullough

How did Bitcoin perform from Oct 2020 to November 8th 2021? +466%. Not too shabby… but things don’t go up forever.

“HODLing is not going to work next time we hit #Quad4 again.” – McCullough in November 2020

And just as market cycles go – things peak. Then they trough. Then they peak again.

How do you know when the peak is in? Well, you start losing a little money, and our #VASP (Volatility-Adjusted Signaling Process) flips TREND, getting you out.

Ahead of our potential #Quad4 in Q1 2022 (and highly probable #Quad4 in Q2 2022) call in January 2022, our Bitcoin Trend Tracker went BEARISH BITCOIN on December 15, 2021 (after 2 days of flipping to Neutral TREND). Bitcoin went down more than -21% after that.

The best thing about our algorithm?

It works.

That’s exactly why we developed our Bitcoin Trend Tracker - a daily dashboard designed with Hedgeye Risk Management’s proprietary trading tools applied to the world's largest cryptocurrencies, including Bitcoin, Ethereum, and a range of crypto ETFs (i.e. MSTR, BLOK, COIN, etc.)

It is designed to help ALL INVESTORS risk manage their crypto positions with MATH/DATA, not NARRATIVES.

Risk manage your crypto positions with math and data, not NARRATIVES.

"HODLing" isn’t an effective risk management process. Timing the market cycles with quantitative algorithms (aka DATA) and getting out at the critical inflection points, is.

Hedgeye Macro analysts are neither Perma-Crypto Bears nor Bulls. We're opportunistic. We get you long to ride the rips, and then get you OUT to risk manage the dips (and protect your hard-earned capital).

Prior to his November 2020 #Quad4 call, McCullough bought back all of his Bitcoin on October 12, 2020 (after selling down his position during September 2020):

The best thing about our algorithm? It works.

How did Bitcoin perform from Oct 2020 to November 8th 2021? +466%. Not too shabby… but things don’t go up forever.

“HODLing is not going to work next time we hit #Quad4 again,” Keith warned in November 2020.

And just as market cycles go – things peak. Then they trough. Then they peak again.

BOTTOM LINE “HODLing” hurts your portfolio. Applying a quantitative risk management process to crypto helps you protect your capital (and grow it).

“I started selling my Bitcoin in the first week of September [2020], I sold it all the way to the first week of October, and then I bought it all back (on October 12th 2020).”

– Hedgeye Founder & CEO Keith McCullough

How do you know when the peak is in? Well, you start losing a little money, and our #VASP (Volatility-Adjusted Signaling Process) flips TREND, getting you out.

Ahead of our potential #Quad4 in Q1 2022 (and highly probable #Quad4 in Q2 2022) call in January 2022, our Bitcoin Trend Tracker went BEARISH BITCOIN on December 15, 2021 (after 2 days of flipping to Neutral TREND). Bitcoin went down more than -21% after that.

Check out Keith making the call LIVE in November 2020

HEDGEYE PRO

ONLY $179 $99/YEAR

AFTER YOUR FREE 30-DAY TRIAL

Our Bitcoin Trend Tracker is regularly $14.95 per month. If you followed our Signals, the ROI on that investment would be astronomical. For a limited-time, we’re giving investors free access for 30 days—no credit card required, no strings attached. See for yourself how our quantitative risk management data can make you a better investor.

You'll also have the option (but not the obligation), to extend access for a full year at 45% of the standard price.

We want all investors to have access to this powerful data; try it free for 30 days.

ENTER YOUR EMAIL FOR FREE ACCESS

(No credit card required, no strings attached)

Check your inbox to confirm your free Bitcoin Trend Tracker trial (don't forget to check spam).

Everything you need to effectively Trade Crypto:

✓

Make better sales at the top end of the risk range and purchases at the low end

✓

Backed by Hedgeye Founder Keith McCullough’s quantitative risk management process

✓

Get daily BUY | SELL trading signals for the world’s most traded crypto assets

✓

Receive price, volume, volatility, sentiment and market data monitored by our Macro team

** As of 2022, the Trend Tracker delivers daily signals for Bitcoin, Ethereum, and a range of crypto ETFs (i.e. MSTR, BLOK, COIN, etc.).

An Indispensable Risk Management Tool for Crypto Traders…

ONLY $179.40 $99/YEAR

AFTER YOUR FREE 30-DAY TRIAL